FAST FUNDING FOR

SMALL BUSINESSES

We Deliver!

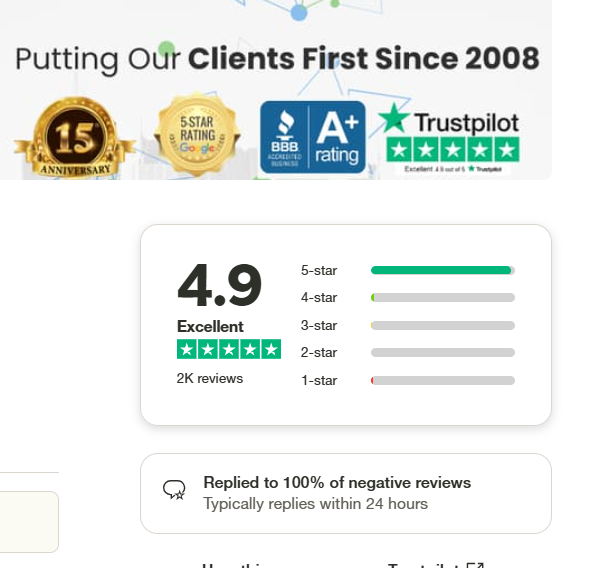

Our Record Proves It!

We Are A Proven And Trusted Partner in Small Business Financing

Empowering small & medium-sized businesses in the USA & Canada.Our unique approach provides flexible funding options for all your needs.

Our dedicated team is focused on one goal: providing reliable funding and support to businesses like yours.

Regardless of credit score, we offer tailored financing solutions to meet every business owner’s needs.

Your success is our mission, and we’re here to make it happen.

17 Years of Success in USA & Canada

Over 1800 Reviews Tell The Tale!

A+ BBB Rating

Our Fast Funding Programs

Basic Funding Requirements

Unlock rapid liquidity with our short-term financing, offering a percentage of monthly sales with flexible daily or weekly repayments. Ideal for immediate needs with minimal prerequisites.

- Time in business: 6 months

- Credit: 500 Credit Score

- Minimum Deposits: $35,000 average monthly bank deposits

- Required Documentation: Last 4 Months Business Bank Statements

- Signed & Completed Application – 50% Ownership Required

Terms: 3-12 months

Payments: Weekly

Requirements:

$35,000+ Monthly Revenue

6 months in business

500 minimum credit score

Instant Business Line Of Credit

Growing fast means you need money that keeps up. Our instant line of credit gets this. It’s here for the big moves, like opening a new location or launching a product, and the small ones, like fixing equipment or buying more supplies.

We’re all about making things simple. If you’ve been around and know where you’re headed, we’re ready to back you up. This line of credit is more than money. It’s a boost that helps you jump on opportunities without missing a beat.

Think of us as your behind-the-scenes team, making sure you’ve got the financial muscle to push forward, whenever you need it. No long waits, no complicated interest rates. Just the freedom to grow your business on your terms.

Easy Equipment Financing

Imagine the possibilities with the right equipment in hand. Maybe it’s upgrading your farm for better agriculture, opening a brewery with the finest machinery, or setting up a restaurant that feels like home.

Traditional paths to financing can feel closed off, especially when you’re just starting out or faced with credit challenges. Not here.|

Our equipment financing removes barriers, We offer a clear path to the tools you need. From lawn care to power loads, dental suites to industrial might, we’re in the business of saying ‘yes’ to your growth.

Let’s make those big moves together, ensuring your business has the equipment it needs to expand.

We simplify equipment financing. Our approach considers your unique journey, making capital equipment accessible. With us, equipment financing is a partnership.

No long waits, no endless paperwork. Just the support you need to invest in what truly moves your business forward.

Merchant Cash Advances

Empower Your Business with Fast & Flexible Merchant

Business Debt Consolidation Loans –

No Minimum Credit Score Required

Simplify your financial landscape with our consolidation options, designed to merge existing debts into a single, manageable repayment plan.

Keep Your Business Moving By Consolidating & Extending Your Debt Payments.

Terms: 6-18 months

Requirements:

$35,000+ Monthly Revenue

1 year in business

Fast Working Capital Loans

Access Same-Day Funding Tailored For Your Business.

Funds can be used for most business purposes such as to buy equipment or inventory, for working capital, or to consolidate debt or merchant cash advances. Fast Closings!

Cannabis Dispensary Financing

All the best dispensaries have one thing in common — lots of awesome inventory. And therein lies the rub.

You need a lot of working capital to operate a dispensary.

It can be difficult to find a line of credit. Traditional financial institutions aren’t offering cannabis companies many financing solutions. Marijuana businesses don’t have the same access to financing options as, say, their peers in beer. That’s where we come in. We can assist you with:

Working Capital

Vendor Financing

Equipment Financing

Dispensary Funding

Line Of Credit

Inventory Financing

Call Or Apply Here